It’s vital that you concentrate on no matter if your lender makes use of this process and to be familiar with the financial implications.

By recalculating the interest allocation applying this rule, lenders and borrowers can know how the modifications will affect the general price of the loan.

4. Loan amortization Investigation: The Rule of seventy eight can be applied to assess loan amortization. By inspecting the fascination allocation all through the loan term, borrowers can decide probably the most cost-successful repayment method.

House equity loans Property fairness loans Allow you to borrow a lump sum at a set level, determined by exactly how much of the house you have outright.

To learn more and a whole listing of our marketing companions, remember to have a look at our complete Promoting Disclosure. TheCollegeInvestor.com strives to maintain its details precise and up-to-date.

Should you’re searching to save money on your vehicle loan, the Rule of seventy eight may be able to enable. This rule primarily states that almost all of one's interest payments are going to be manufactured while in the early months of one's loan, with the amount decreasing because the loan progresses. Because of this, by paying out off your loan early, It can save you a substantial amount of money in desire payments.

The Rule of seventy eight is a concept that is often pointed out when discussing loan repayment. Though it might audio scary in the beginning, being familiar with this rule can offer valuable insights into how your loan is structured And just how interest is calculated.

There are a variety of calculators on this site that will permit customers to enter extra or additional monthly (or other frequencies) payments and see the interest saved.

2. Amortization Agenda: A different alternate is the use of an amortization program. This process will involve calculating loan payments based on an amortization formula, which usually takes into consideration the loan volume, curiosity price, and loan time period. Using an amortization program, borrowers can see a breakdown of each payment, together with just how much goes to the principal and simply how much toward interest.

Some lenders use choice approaches, including the Straightforward Curiosity approach or perhaps the Actuarial strategy, which can provide additional overall flexibility and likely decreased desire expenditures.

See Overall Interest Owed: Immediately after inputting the loan information, you’ll right away see the entire interest owed around get more info the loan. This gives you a clear image of simply how much curiosity you’ll be paying out about the loan time period.

The Rule of 78, often known as the Sum of your Digits process, is a way employed by some lenders to compute the desire they demand you.

In 1935, Indiana legislators handed legislation governing the interest compensated on prepaid loans. The formula contained During this law, which decided the quantity because of lenders, was known as the "rule of seventy eight" system. The reasoning guiding this rule was as follows:

So, how do lenders make use of the Rule of 78 to compute early repayment penalties? Any time a borrower decides to repay their loan ahead of the agreed-on term, the lender could charge a penalty to compensate for that fascination they would have gained When the borrower experienced made normal payments for the full expression.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Molly Ringwald Then & Now!

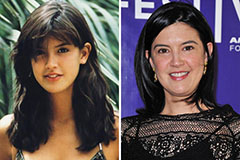

Molly Ringwald Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!